Several months ago I predicted that rescuing Fannie Mae and Freddie Mac would entail a massive taxpayer bailout, and I was correct. Keep in mind that I am not a financial analyst or stock broker and have no degree in economics, unlike many of the pundits. I can, however, add up two plus two.

For 20 years both Democratic and Republican administrations ballyhooed the benefits of unregulated financial markets. Alan Greenspan believed that if left to its own devices, an unregulated financial market would pass risk to those who could best afford it and not to the commercial banking system or taxpayer. Accordingly, Wall Street, mortgage companies and banks were unencumbered in the creation and sale of mortgages and mortgage securities that defied the laws of gravity and common sense. Mortgages were given to people who could not afford them, and offered without verification of income or ability to pay. Hence, property values skyrocketed and America underwent a decades’ long housing boom.

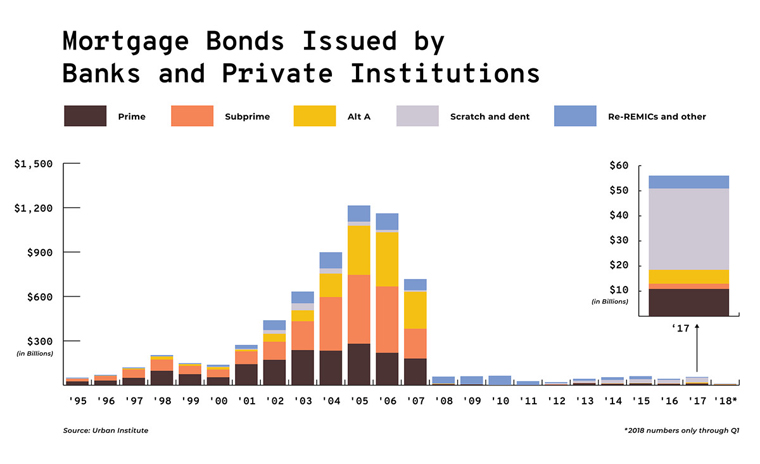

To make matters worse, the so-called sub-prime mortgages (actually “junk” mortgages) were bundled by Wall Street into investment vehicles and sold around the world. Meanwhile, Freddie Mac and Fannie Mae bought the overvalued paper issued by banks and mortgage companies without hesitation to the tune of $5.4 trillion, half the nation’s mortgage debt; backed by the U.S. government, neither company felt the need to be terribly careful or prudent. Now that the true phantom value of their loans and holdings has been calculated, the U.S. government has taken control of both companies, for the sake of market “stability.”

Stability, in this case, means satisfying China, Arab states, Russia and other countries that purchase our government bonds, as well as bonds issued by Freddie and Fannie. While the taxpayer and the common stockholders foot the bill, the assets of bondholders in both companies will be protected by the federal government. We are told this is due to the need to keep them confident in our financial wellbeing so they do not begin to shift their foreign investment to other currencies. The $200 billion allocated to stabilize Freddie and Fannie will not be enough, I believe, and the bill may go as high as $500 billion. Nobody really knows.

America continues to borrow more than it can pay back, and the annual deficit has widened during the past eight years to a staggering $410 billion. Economists, sobered by the prospect of a deep worldwide recession, are now talking about a return to the era of regulated financial markets. When the taxpayer is asked to bail out Wall Street, after all, they expect to be protected from such risks in the future, say the pundits. Whether either political party is ready to embrace highly regulated markets, however, is uncertain. The free market neo-liberal economic theory has gained such widespread adoption that it is nearly inconceivable that a reverse course can be plotted, let alone followed.

As I have stated in previous columns, the emptiness of the monetary system eventually reveals itself. It has no absolute characteristics of its own, exists entirely in imaginary space and is supported through common consent. When harnessed by greed, money is destructive; when employed for the good of others, it spreads blessings. Bereft of any inherent qualities, money is purely what we make it.