There was a time when paying bills was a private affair, as were auto loans or credit card charges. An invoice was received, a check or money order was sent as payment; sometimes one would visit a local business and pay an invoice in cash. These transactions were based on trust, and reinforced the mutual social contract of trustworthiness between members of a community. Reaching people by telephone was easy; there was no voice mail, “talking” computers, or menu choices to press, just ordinary folks at the other end of the line. Establishing human relationships mattered, a comforting and even tender part of everyday life.

Alas, society has changed. Along with privacy, personally conducting life’s daily activities has diminished, and “paying the bills” is now fully automated, a completely impersonal act. Checkbooks, quaint artifacts of personal history, have been almost entirely replaced by debit cards, automated payments and online bank statements.

There are those who find such changes acceptable, even positive, as they relieve more time for personal entertainment and self-indulgence. Yet convenience – not being troubled by routine tasks that are easily completed by machines – slyly works its way into the psyche. Laziness replaces discipline and social relationships shift from personal to digital. Self identity morphs as well as each person becomes a calculable unit, transformed into streams of numbers and statistics made available for data-mining and sold as a commodity to marketers. This is the insidious and seductive instrumentality of a voracious globalized civilization focused on profit and exploitation, a system that strips away our humanity as efficiently and effectively as it strips away rainforest.

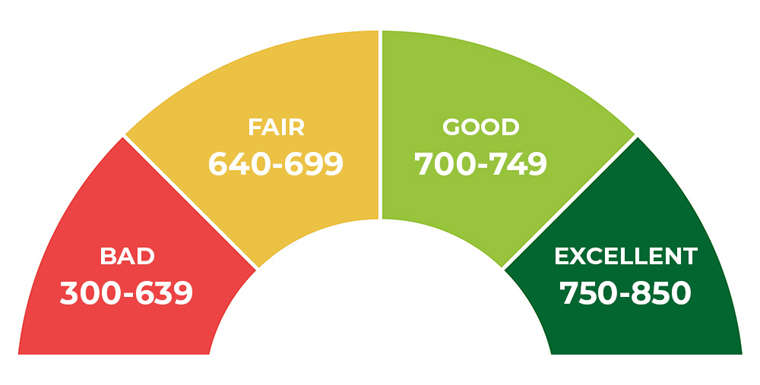

One particularly blunt instrument of civilization is the credit score, a three-digit number assigned to each of us based upon the debts we owe and the bills we pay. Credit scores are assigned by three major corporations, each of which supply information to lenders like mortgage companies, banks, auto dealerships, and so forth. Along with the score, a full credit report lists the amounts of any and all debts owed or paid to whom for how long, as well as any payments in dispute. The credit score is calculated by machine based on a formula developed by each company. If a score is low, a borrower’s interest rate will be higher than that of a borrower who’s score is high. The formula does not account for reputation, decency, or honesty; in short it ignores the particularly human qualities that form the ground of a good society.

That debts and payment histories are no longer private and are openly shared by these three large corporations is accepted today as perfectly normal. When a loan is made, permission to share the loan information with credit reporting agencies is part of the loan agreement. One could refuse, but then the loan would not be made. In this way each of us are diminished as people, coerced into accepting a dehumanizing instrument of corporate authority. Taken to its logical conclusion, such a system resembles Orwell’s 1984, wherein people are intentionally reduced to unwitting instruments of authoritarian power and lack any freedom whatsoever.

It is only within the creative tenderness of real relationships we find an antidote to the cold instrumentality of modern civilization; the warm human heart of kindness and compassion. Forget credit; love, as the Beatles sang, is all there is.